In his book Radical Technologies, the urban designer Adam Greenfield calls cryptocurrency and blockchain the first technology that’s “just fundamentally difficult for otherwise intelligent and highly capable people to understand.” (link)

What is an NFT?

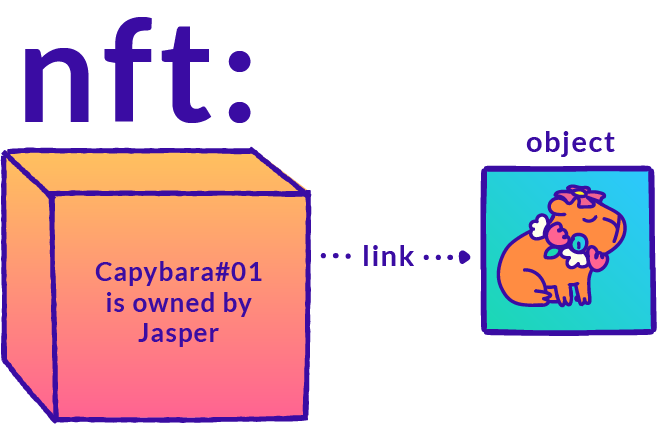

You can think of an NFT as a digital, verifiable, publicly-accessible way of representing ownership of something – a certificate of authenticity for something digital that can be owned by 1 person at a time. This person must have access to a digital “wallet,” which is essentially an account in this system, to store the certificate.

That something has to be digital, due to how this system works, but basically everything can be represented digitally these days. It could be a JPEG (like those mutant apes you see), a deed to a house, a license key to a piece of software, a ticket to an event, an entire movie, an album, an item in a video game, etc.

Blockchain

NFTs live in a public place that keeps track of every transaction that uses whichever cryptocurrency the NFT is built on. This public place is called a blockchain. There are many blockchains, each with their own technology and capabilities. There is no “main” blockchain – though some blockchains are more widely adopted than others. You can learn more about how blockchains work in our Non-Technical Blockchain Explanation.

A blockchain is a kind of database—a way to store data. Databases have existed for a long time, and almost every app or website you use nowadays, from this one to Google to Twitter to Discord to TikTok to Reddit, all make use of a database of some kind to store data. NFTs, however, rely on blockchain technology because it guarantees an immutable public record of ownership and does not have one single entity storing and controlling all the data contained within it.

What’s actually in an NFT?

Due to technical limitations (see section on blockchain details), an NFT can only store a very small amount of data. The more data an NFT stores, the more expensive it becomes for the person creating it. The reason NFTs become more expensive the larger they are is because the cost to create and store it on a blockchain, or most commonly known as ‘minting’, is usually based directly on the amount of work required to process the data. More data = more work = more $$$. This is the case for most NFTs.

To get around technical constraints and reduce the costs, NFTs typically store a publicly-accessible link to their attached object (as opposed to storing the object itself). For example, in the case of an event ticket, the ticket itself would be stored as a PDF on a server somewhere, and the NFT would store the hyperlink pointing to that PDF. The hyperlink takes up less data than the ticket itself, so the costs associated with the link are lower.

It is very possible that the connection between the hyperlink and the data it references could be severed, like how links to unmaintained websites eventually stop working. This phenomenon is known as link rot. There are some ways to minimize this risk, which many popular digital art NFTs make use of today, but none of these mechanisms are completely foolproof.

Example time! Let’s say you had an NFT pointing to a JPEG, but the link went dead because the website the JPEG was hosted on went down. This situation is like purchasing a product on eBay that then never gets delivered, or the wrong product gets delivered. You could still prove that you paid for the item, as you have the receipt, but the seller could refuse to accept your warranty return and/or has deleted their account. To get the right item delivered, you are dependent on the seller agreeing to send the item you purchased. In the same way, you and the creator of the item pointed to by the NFT can verify your purchase and fix the broken link, but only if both parties agree.

But what if that link is on a company’s server, and that company goes out of business? Or what if you can’t get in touch with the creator of the NFT? Or what if the original owner blackmails you and agrees to hand over the original data only if you pay them a certain ransom?

Well, then you might be out of luck. It depends entirely on the agreement you made when you purchased the NFT. Speaking of which…

Smart Contracts

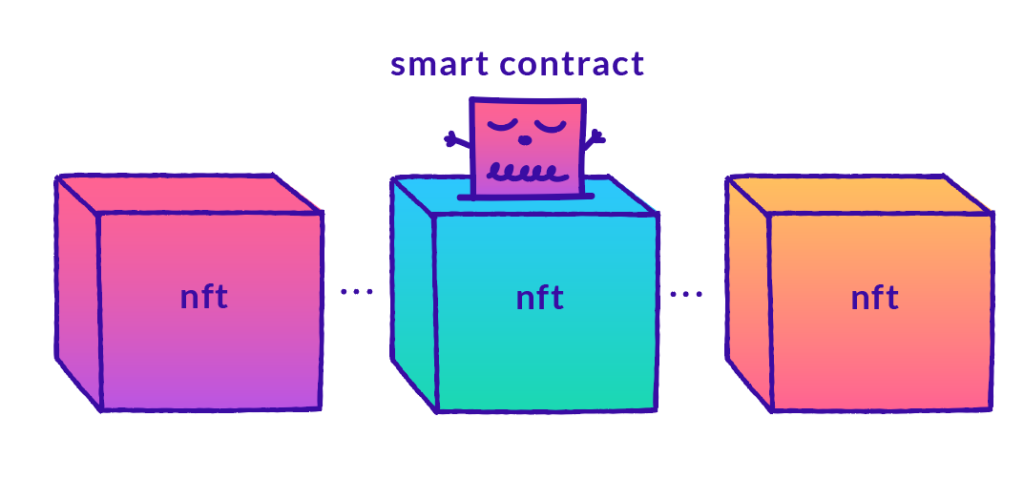

When you purchase an NFT, you agree to what’s called a “smart contract” – a small piece of code that specifies things like royalty payments, ownership, what and how much each party receives, and other details. In the NFT world, code is law. This means that any operations that go against the code are rejected. Smart contracts are intended to replace humans in the transaction process, leaving the processing of the actual transaction and any questions up to the smart contract code to handle.

This smart contract gets attached to your NFT and stored in the publicly accessible place (the blockchain) that we mentioned earlier, forever.*

* = as long as the blockchain lives (see our blockchain explanation for more info)

Who owns what?

The idea of “Digital Ownership” has really taken off with the proliferation of NFTs – it stands for the possibility of possessing and controlling digital assets, backed by a technology like Blockchain. Alongside the push for the “democratization of digital space” has come the idea that we could own digital goods in the same way we own physical goods.

It is very important to note that unless otherwise specified, no form of legal ownership is actually transferred – only an acknowledgement that someone else is now in possession of the object. As of right now, in a traditional legal sense, owning an NFT does not grant you any rights over the object that NFT points to unless otherwise specified in the smart contract. By default, the only ownership actually transferred is of the token which lives on the blockchain. By following our “certificate of authenticity” analogy for an NFT – the certificate changes hands, but by default, the linked object does not.

NFTs do not restrict sharing or copying of the attached data and do not prevent creating new NFTs with exactly the same data attached. This means, for example, there is nothing stopping someone from creating two copies of a one-of-a-kind NFT.

It should be noted that, thus far, regulations have mostly not caught up with NFTs. So, while there may be agreements signed and stored for all to see, the necessary legal paperwork would still have to be filed to, for instance, transfer copyright, patent, etc. This is intentional – one of the goals of NFTs is to avoid the need for regulation by having a public, decentralized, consensus-based way of assessing ownership.

The reason copyright, patent, and other intellectual property rights have any legal standing to begin with is because we as a society have agreed it does. NFTs aim to redefine ownership using code.

This has not been without its problems – it has already become commonplace to see people minting NFTs to make money off intellectual property that isn’t theirs

For example, some proponents of NFT art claim NFTs are the future of funding and supporting digital artists, however some creators who have had their art stolen and minted as NFTs like Loish and Simon Stålenhag might disagree.

One of the possible ways to remove ‘’stolen’’ content from the internet is through a DMCA takedown, which stands for Digital Millennium Copyright Act – a Copyright law that protects owners of copyrighted material whenever these are improperly used online. Can someone file a DMCA claim on NFTs? It depends. Some NFT marketplaces allow you to, some don’t. Some do allow you to file a DMCA claim, but may not act on it.

Regardless, filing a claim is a difficult, time-consuming process, and more often than not the ones profiting off someone else’s work can take the money and run. Additionally, since blockchains are immutable, you can’t really request removal of your NFT – your best bet is to convince every service that provides access to the NFT to hide it from view.

Cryptocurrency

In the context of this discussion – when we say money we refer to cryptocurrency. Cryptocurrencies, or ‘crypto’, are digital currencies built on decentralized blockchain networks that track and verify all transactions – past, present, and future. A unit of cryptocurrency is referred to as a ‘coin’ or ‘cryptocoin’. When coins are created, removed, or transferred from one account to another, that transaction is recorded on the blockchain.

It is important to call out that, historically, cryptocurrencies were simply investments that were exchanged for the purpose of monetary gain. NFTs are the first native case for spending cryptocurrencies inside their “ecosystem”. They offer an asset – a reason to spend cryptocurrency.

In order to exist on the blockchain and be transactable, NFTs are priced using the cryptocurrency supported by the underlying blockchain where the NFT resides. This means the value of an NFT depends on 1.) the value of NFTs as a concept, 2.) the value of the underlying blockchain network and its supported currencies, and 3.) the value of cryptocurrency as a concept.

As cryptocurrencies lack government backing, their value is 100% speculative. This means that the value of cryptocurrencies, and thus NFTs, is subject to extremely large fluctuations. The value typically goes up when more people are interested, and goes down when fewer people are interested. Again, this is intentional. One of the core tenets of cryptocurrencies is to be completely decentralized – in other words, free of regulation.