In this section we will discuss how NFTs are currently being used in games, their proposed future use cases, and the various issues that come along with these uses, present and potential.

Play-to-Earn (P2E)

P2E provides an additional monetization route for games, in which players are capable of buying, loaning, selling, or trading in-game assets through the use of cryptocurrencies, with a slice of each transaction going to the game publisher. Commonly associated with Play-to-Earn games is also the concept of “metaverse”, an umbrella buzzword with several different meanings. We will define it as a multiplayer virtual reality space in which people can interact with the world and amongst themselves, in a similar fashion of the early 2000s game Second Life.

The first P2E “game” is considered to be CryptoKitties, which launched in 2017. CryptoKitties is a breeding application in which you breed kitties with distinct characteristics to get more kitties, although it is more accurately described as a gamified platform for cryptocurrency trading, buying, and selling since there is little-to-no gameplay. In this application you use Ethereum cryptocurrency for all your transactions.

It’s important to note that Play-to-Earn games require some players to earn, and some players to play – otherwise those who Play-to-Earn have nobody to sell to. This limitation thus requires constant new importing of wealth into the game, which requires a constant stream of new players or existing players putting more money into the game.

Note that a crypto wallet is required in almost all of the play-to-earn games, even if you are playing free-to-play.

Current Use

In the latest play-to-earn games, NFTs are used in two main ways:

- In-game assets that are bought, sold, loaned, or traded for other assets and cryptocurrency

- Out of the game collectibles and memorabilia

In-game assets

The majority of P2E games use NFTs as in-game assets, whether they are a mandatory token that players need to buy before playing, cosmetics, or assets that have gameplay impact. These transactions are sometimes held in the game’s own marketplace or in other NFT marketplaces like OpenSea. Axie Infinity, for example, has a selection of in-game assets as NFTs: characters (axies), land and items; Tom Clancy’s Ghost Recon Breakpoint offers cosmetics; Decentraland offers cosmetics and land; The Sandbox offers land and entities, like buildings, citizens and animals.

Outside of game collectibles

In some cases, there are out-of-game marketplaces and stores in which players, enthusiasts or fans can buy collectibles and memorabilia. These items are not usable in-game, but rather a symbolic item. A good case study for this use is Konami’s NFT collection called Castlevania 35th anniversary NFT, a collection of ‘’game scenes, BGM (original music themes), and newly drawn art from the Castlevania series’’ to celebrate its anniversary. The items were auctioned on the NFT platform OpenSea.

Regarding monetization model, NFT games can be categorized into four main groups:

- Games that require initial purchase of assets

- Games that require initial purchase of cryptocurrency

- Free-to-start games that don’t require initial investments

- Premium games that require players to buy the game itself

P2E Games Requiring Purchase of Initial Assets

Examples of games that depends on players buying assets to play are Axie Infinity, in which players must buy three characters before playing; Sorare, in which players must buy five collectibles before being eligible to play; TownStar, in which players are required to place in-game NFTs before they can earn TownCoins.

Interesting facts about Axie Infinity

During our research, some interesting aspects of Axie Infinity stood out and we’d like to address them here. Axie Infinity players have informally adopted a ‘scholarship’ model recognized by the official game, consisting of account owners who share their accounts with other players for a slice of the profit. It works like this: a manager buys accounts and fronts any initial investments required (cryptocurrency or in-game assets). The manager then recruits players (called scholars) to play using these accounts and earn in-game rewards.

The rewards are then split between the manager and the scholars according to their agreement, which could be for example 50/50 or 60/40 on a regular cadence. Scholars need to meet daily goals set by the manager, including weekends, to ensure their weekly earnings.

This labor structure generates some form of informal jobs and brings in the issues associated with it – from payment instability to lack of labor rights. This system was likely created due to the imbalance of ranked matches in the game, as the potential earnings are higher in higher-rank battles, which is directly proportional to the investment made in the game.

The natural result of this situation is that player accounts who invest a lot of money can participate in higher-ranking battles and earn more than lower-ranking accounts. You can watch an in depth explanation here if you would like to learn more.

Balancing an in-game economy is tricky. Balancing an in-game economy with real-world implications is both tricky and risky – and recently for Axie Infinity, the value of one of the critical pieces of their economy crashed, sending the volume of Axie transactions plummeting and the value of Axie’s assets tumbling along with it. Axie Infinity flooded their market with too much in-game currency, resulting in massive inflation. This went largely unnoticed because speculative investors were buying up as much as they could.

As we read above, Play-to-Earn already sits atop a shaky foundation, relying on a vulnerable labor market that is only present as long as they can earn as much or more from playing these games than they could otherwise. And when the value of the currency fell, many of these laborers stopped logging in, sending the Axie economy into a death spiral.

P2E Games Requiring Initial Cryptocurrency Investment

Some games require an initial investment of cryptocurrency before playing, which is the case of Aavegotchi, requiring an initial investment of their in-game token called GHST (ghost); Alien Worlds, requiring a minimum stake of 10 WAX tokens for new players; Arc8 mobile game platform requires an initial investment on their internal GMEE token for the earning tier (although players can play the free-to-play games without earning any tokens).

Free-to-Start P2E Games

Examples of games that don’t require initial investments are Gods Unchained, in which players get a free starter pack and can create their in-game card NFTs after grinding and collecting wins, subsequently selling and trading them with cryptocurrencies; Splinterlands, in which players can play but must buy a Summoner’s Spellbook to earn rewards; Decentraland, in which players can explore the common areas of the world and make simple quests, but depend on cryptocurrency investment if they want to play games, buy land (via NFTs) and purchase collectibles for their avatars; The Sandbox, similar to Decentraland, also allows players to freely explore the common areas but requires cryptocurrencies to buy land (again via NFTs), assets and play games.

Premium P2E Games

An example of premium P2E game is Tom Clancy’s Ghost Recon Breakpoint, in which players purchase the premium game and have access to all gameplay content, but they can also buy limited-edition cosmetics NFTs called Digits using platform Ubisoft Quartz and/or other approved platforms.

NOTE: Since we wrote this section, Ubisoft has announced they have ended development of Ghost Recon Breakpoint. We highly recommend reading this Forbes article discussing what happens now for the owners of NFTs that were made specifically for this game.

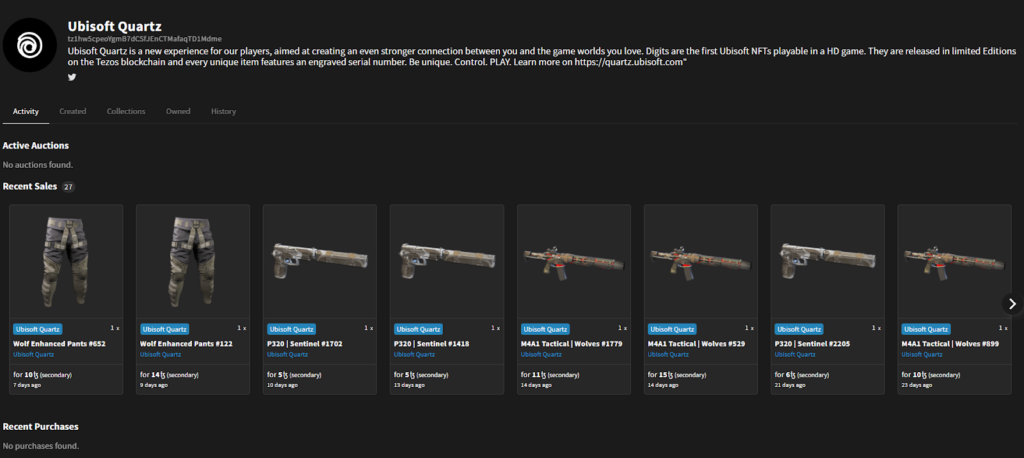

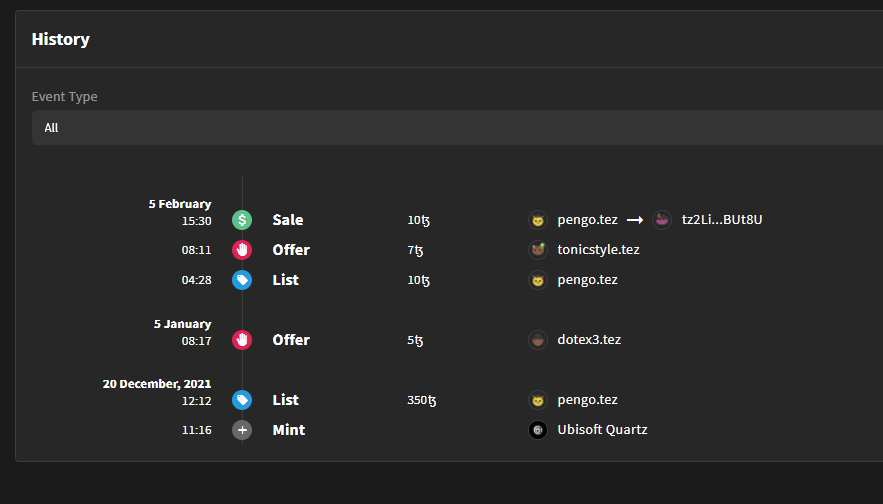

To give an empirical example, we can take a quick look into Ubisoft Quartz transaction history in the websites Objkt and Rarible. Objkt shows a total of 31 sales in over three months as of April 10, 2022.

Recent sales shows a weapon skin that was minted by Ubisoft, bought and listed by the first owner for 20 Tezos (cryptocurrency) and then sold to another user who then listed it for 10,000 Tezos.

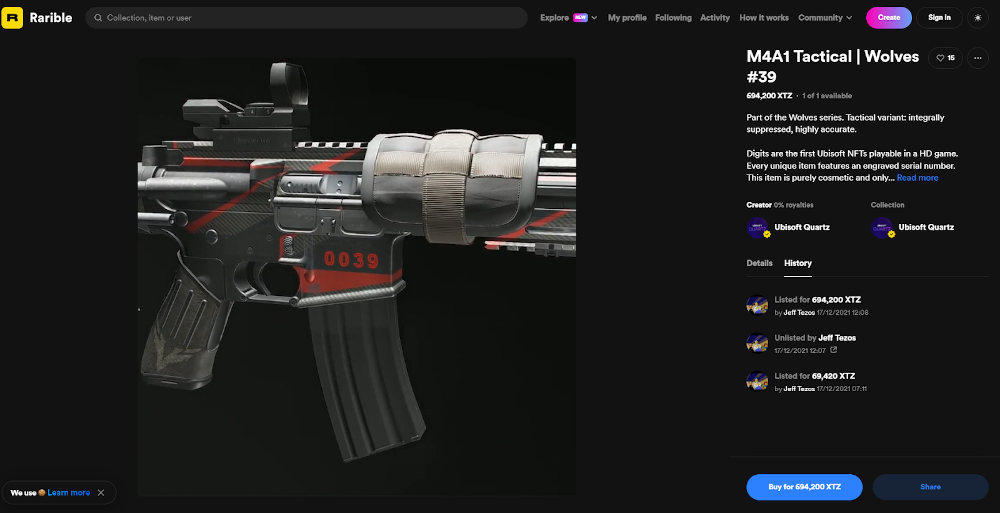

In the other platform they are available, Rarible, the same weapon skin is listed for 694,200 Tezos. The transaction history shows that user ‘Jeff Tezos’ initially listed it for 69,420 Tezos, regretted it and relisted it for 10x the initial value they had in mind, just because.

So in this example, we have two identical weapon skins whose only difference is the number written in the magazine, but they range in value from 20 Tezos to 694,200 Tezos.

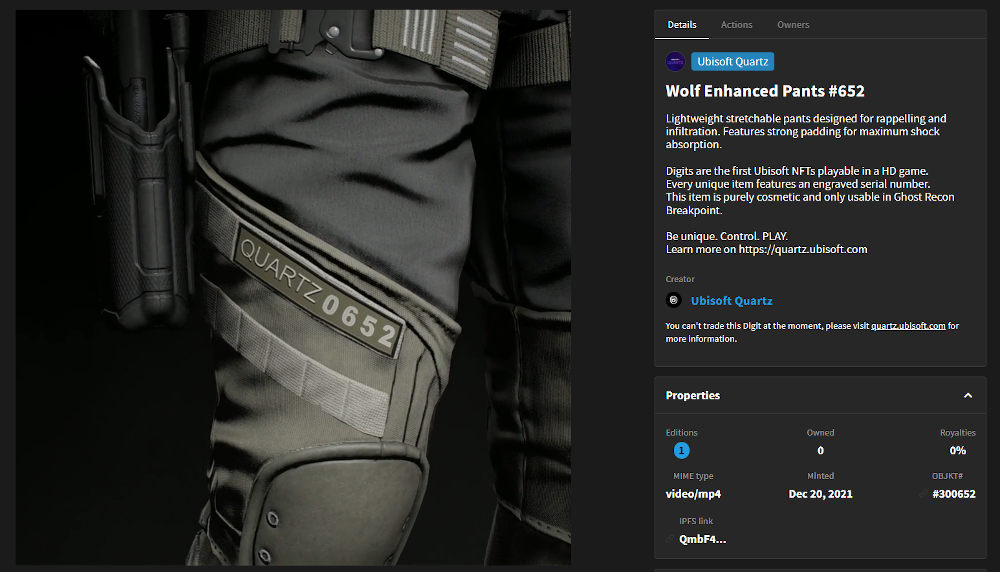

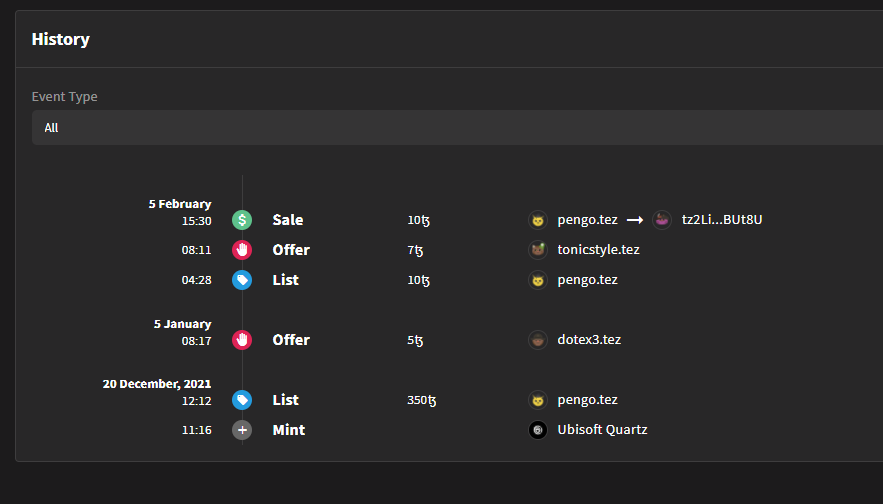

Another item listed in the Ubisoft Quartz marketplace is a pair of pants cosmetic:

In the Objekt marketplace, it was first listed for 350 Tezos, for which the seller accepted an offer of 5 Tezos. It was subsequently sold and bought by a few users with the most recent sale accounting for 10 Tezos.

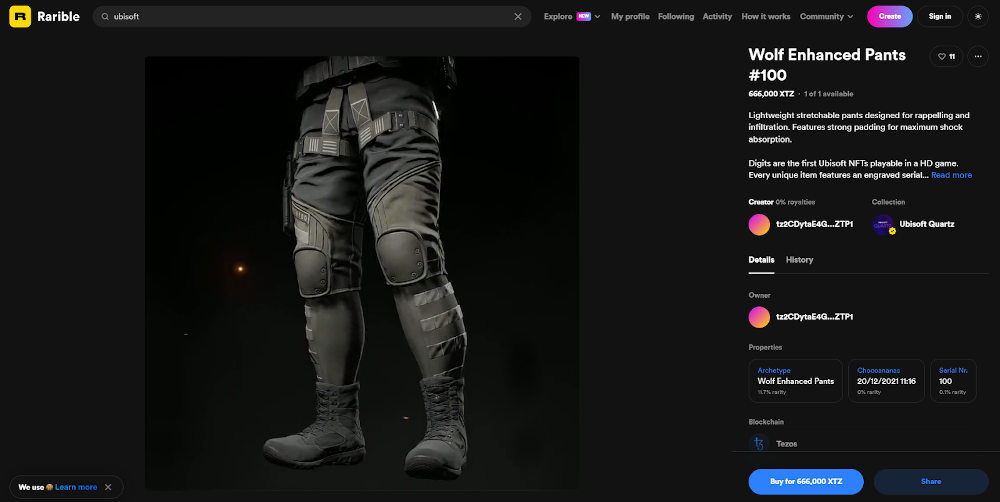

The same pair of pants with a different serial number in the knee is listed for 666,000 Tezos in the Rarible marketplace.

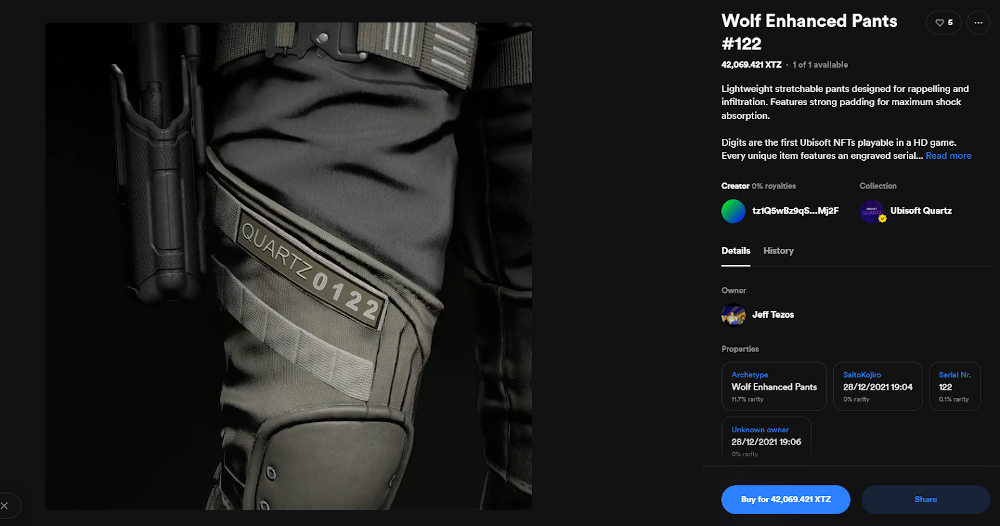

Or you could even buy it from familiar user ‘Jeff Tezos’ for 42,069.421 Tezos.

The reason why these prices are so absurd is because they can be this absurd. There are no rules regulating the market value. This is a glimpse into just one example of how NFTs are being used today in games. Since all blockchain transactions are public, this information is available on all NFT trading platforms and gives concrete data into the model, which is very helpful when discussing and debating something complex and highly conceptual. We urge all interested parties to take some time to dive into the empirical uses we have today.

It is worth noting that NFT sales are currently rife with wash trading, a method of artificially inflating the value of a particular NFT by trading it between two or more accounts which the owner of the NFT holds for increasing amounts of money. Without significant investigation, it can be hard to know in which situations when this is happening, and when there is genuine interest in the NFT for the price it is listed at or sold for.

Intended future use

Future efforts for Play-to-Earn games are focused on popularization, platform expansion, interoperability, job creation, transitioning into a DAO, and community-driven economies.

Popularization is a common shared goal for all play-to-earn, blockchain, and metaverse games, with the main intention of consolidating their names through partnerships with celebrities, brands and advertising investment. This strategy is not new for crypto initiatives, where partnerships with celebrities like Paris Hilton, Jimmy Fallon, and brands like the NBA are becoming commonplace to add credibility and influence their followers. NFTs in games are an effective way to legitimize and bring more people into the cryptocurrency world, which is highly beneficial to any cryptocoin and especially to early adopters.

The majority of Play-to-Earn titles are operating on PC as a platform, while some are also present on mobile. PC and mobile have an already existing integration with crypto wallets, making operations easier and streamlined for such games since each transaction you make requires players to open these wallets in external applications if the game doesn’t do it on its own. Bringing these games to consoles like PlayStation, Xbox, and Nintendo Switch would require efforts in cryptocurrency wallet integrations.

The intention of achieving interoperability between different games is present in several Play-to-Earn game roadmaps, and refers to the ability to use individual in-game assets in multiple games. Although this might be true for new games created under the same platforms, it’s an unfeasible goal for already existing games or games that are created in different platforms/using different engines.

Converting P2E from a side gig into a real job seems to be the goal for some but not all of those games. Their intention is to make earning a living wage by simply playing the game for the required amount of hours a possibility for those who want it. Yield Guild Games is one of the organizations aiming for this – it consists of a community of play-to-earn gamers who help each other get started with NFT games. It’s important to note that Yield Guild does not employ anyone, so all players under the guild are categorized as informal (read more in NFT risks: Informal Jobs).

Becoming a DAO is the intention of some Play-to-Earn studios and games, while others are focused on transitioning into a decentralized organization system. A DAO, or Decentralized Autonomous Organization, consists of “a community-led entity with no central authority. It is fully autonomous and transparent: smart contracts lay the foundational rules and execute the agreed upon decisions”. Speaking in common terms, it’s an organization that is ruled by a set of protocols run by a computer program instead of a human-composed institution, although a human would need to create and code all these protocols beforehand.

You can find more about DAOs here and read about the famous hacker attack that brought the first DAO to failure, causing a hard fork into the Ethereum network that exists to this day. Play-to-Earn games and studios are interested in becoming decentralized organizations where players could own stakes and participate in all the decision-making through a voting system. (read more in NFT risks: Decentralization)

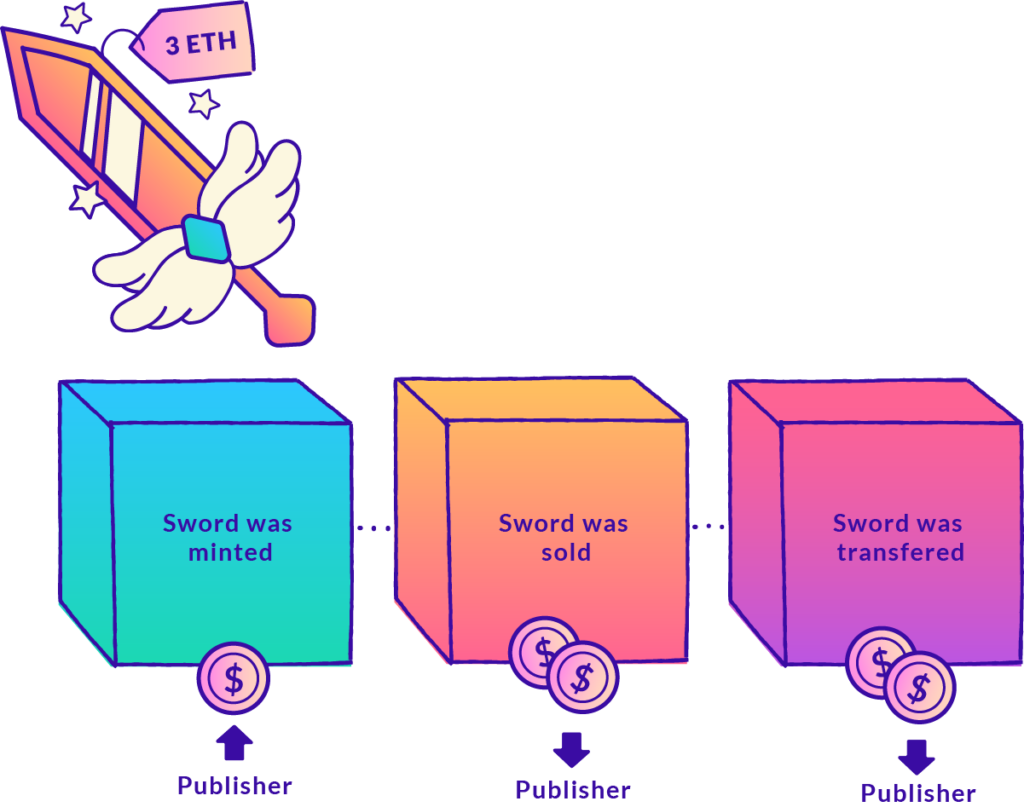

Community-driven economy is the name given to the end goal of some studios, most notably Ubisoft, who calls it a ‘new economic system’ for gaming. It stands for the ability to resell in-game assets after a player doesn’t want it anymore or after they finish the game. To obtain these resellable assets, players would need to buy or invest time to get these assets. In-game assets would be a static supply – meaning the studio will decide both how many assets are going to be listed and their initial prices, resulting in some assets becoming rarities while others remain common. This model is very similar to what exists today with physical card games like Magic: the Gathering* , where certain limited-issue cards cost a lot while common cards cost less. The primary difference with NFTs is that all assets are digital, and the studio earns a percentage of every transaction made, even on resales.

Here are some factors that will likely play out in this model (all examples used are purely fictional):

- Content’s static supply will be determined by studios and publishers, determining how rare an item is and by consequence determining its relative initial value

- Studios will determine how much an item costs initially

- Studios will determine how to get assets, in case of grinding, and what are the chances and circumstances of a drop (ex: 1% chance of a rare item drop whenever you defeat a boss)

- An in-game action that triggers a NFT asset drop will have real world cost, commonly known as minting fees. Either publishers, studios or players have to pay for the drop.

- Players will acquire assets, through buying or grinding

- Players will trade, sell, and buy items in supported marketplaces

- Studios will earn royalties from each transaction

- Items will have a floating value depending on supply and demand. A rare Christmas skin might be in high demand during the holidays and cost a lot of money, but it might probably become cheaper during the year. It might become an ultra rare cult skin though, and rise in value over time.

- Given that games are not eternal, at some point certain games will be sunsetted and their NFTs might drop in value. The interest in pants number #18.743 from Shooter Game III might not be that high for players playing Shooter Game V. But as said above, if it becomes a hit, maybe pants number #18.743 will rise in value even for later games

- Assets bought will become outdated as we progress to newer and newer Gen technology. A Shooter Game 3 weapon has way less polygons and texture density than a Shooter Game 5 weapon, which might interfere in their perceived value and how they fit visually

After going through these factors, the new economic system consists, then, of a digital collectibles trading marketplace that uses cryptocurrency and gives studios a percentage of revenue from transactions.

It comes with all the characteristics of any collectible market, like physical Magic the Gathering cards, stamps, classic paintings, or rare first edition books – most notably floating prices based on supply and demand. Some people are into it for the collectibles themselves, others are into it as an investment. In this model, players will have a parallel cryptocurrency marketplace to trade game collectibles that will change price over time.

In some cases, studios might put this creative effort in the player’s hands, using a player-created content model instead of studio-created content. This approach is slightly different and would shift costs and responsibilities into the player’s hands, as they would be primarily the ones generating content. In this case, players or content creators would pay for initial minting costs and gas fees and split royalties with the studios or publishers for each transaction made in the future through a smart contract. A few notable examples would be player created skins and mods.

Risks

- The creation of informal jobs

- Deeply changing the motivations to play games

- “Number go up” discourse and exposing players to it

We encourage risks to be evaluated before implementing Play-to-Earn monetization or joining a Play-to-Earn game as a player.

2 As an interesting anecdote, Wizards of the Coast (publisher of Magic: the Gathering) recently took down an unofficial project aiming to merge the worlds of Magic with Cryptocurrency. ”mtgDAO” proposes a confusing plan in which ”NFTs can be thought of as tickets to enter tournaments or a way to represent temporary ownership in a cube draft, not as ownership of the copyrighted card”. Read more hereand visit their whitepaper here for more information.